Rating Lender Methodology

At BadCredify, we aim to help you make sure-footed financial choices. We get paid by our associated partners, who we’ll always name. However, all thoughts shared here are our own. All our reviews and pieces are objective and transparent.

After our mavens gather info about the four critical portions of our scoring model, lenders get a rating from one to five — five being the best. For instance, a lower APR range leads to a higher score, whereas a higher APR range results in a lower rank. We aim to give clear-cut ratings so you can pinpoint the right lender for your situation.

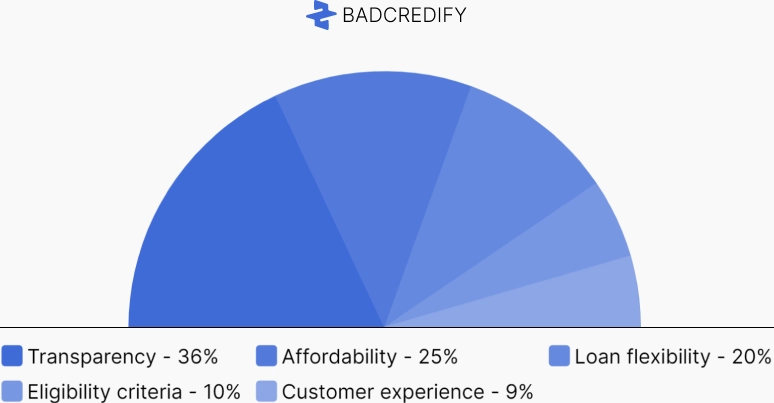

Here are our main pillars for reviewing lenders:

How We Do It?

Transparency (36%)

We look at how lenders set up their websites and application processes to see if borrowers can quickly determine if a loan would work for them. It includes how easy it is to find essential details like interest rates, fees, and rules. We also think about how clearly lenders explain credit reports. They should say which major credit companies they send loan payment histories to.

Affordability (25%)

We look at the yearly interest rates lenders charge (APRs) every six months to see how they compare. We check what range of APRs each lender offers. We also look at fees like getting a loan or paying late. We also see if lenders give people chances to pay less interest.

Loan flexibility (20%)

BadCredify looks at how much flexibility lenders give borrowers. It considers the different types of loans available, how easy it is for people to get loans, if borrowers can pick when payments are due or change the dates, and if people can refinance their loans.

Eligibility criteria (10%)

We consider the rigorousness of each lender’s underwriting practices, including whether they do a hard credit check before providing a loan, offer pre-qualification to all borrowers, and whether they provide loans to a wide range of borrowers.

Consumer experience (9%)

We look at what customers go through when getting a personal loan. We focus on how easy it is to contact someone for help and how easy it is for the borrower to make their payments on time.

Review Team

Our personal loans assessment squad is a mix of reporters, authors, and editors tackling conventional and high-interest personal loans. Our team boasts writers who’ve contributed to The New York Times, The Associated Press, USA Today, MSN, MarketWatch, Yahoo Finance, and other top-tier media. Besides, our loan experts are regularly sought for their insights on industry updates and trends affecting consumers.

Meet our team:

Risk Assessment and Decision Making

Good information is essential for deciding if someone deserves a loan. BadCredify looks at financial details about a lender to see how risky it is to borrow money from them. Wrong information can cause mistakes in risk decisions.

Fraud Prevention

We aim to provide concise and transparent information to catch and stop fraud. BadCredify has substantial ways to check who lenders are and make sure they provide is authentic. Wrong information can mess up these fraud checks, and that could cause the website to lose money or damage its name.

Credit Reporting and Analysis Clause

Banks and lenders often tell credit bureaus about the credit of people who borrow money from them. It helps credit bureaus make complete credit histories for borrowers. However, we aim to provide consumers with lenders that don’t damage their credit scores and make alternative credit verifications. If you have questions or suggestions, contact us for more information.