Best 500 Credit Score Loan Options — Compare Online Lenders in Minutes

BadCredify introduces the best 500 credit score loan options for 2024. Compare different deals from various online lenders side-by-side and make a suitable choice.

Written By:

Edited By: Janice Myers

Posting Date:

The minimum credit score requirement set by traditional loan lenders usually ranges between 560 and 670. Qualifying for standard personal loans can be challenging with a 500 credit score as it falls into the bad credit score category.

BadCredify found reliable loan providers who may approve credit applications for borrowers with a poor credit score. We also covered alternative loan options with a higher chance of approval, such as secured loans and loans requiring a co-signer.

Here are the best 500 credit score loan options to borrow money online.

The Best 500 Credit Score Loan Options (Offers for Bad Credit)

★★★★★

Est.APR

6.40% – 35.99%

Loan amount

$1,000 – $50,000

Min Score

300

More About

PROS

- Quick access to loan funds;

- No prepayment penalties;

- Flexible monthly payments;

- Beyond credit score verification (soft credit check);

- Flexible loan amounts.

CONS

- Origination fees up to 10%;

- High annual percentage rate;

- Co-signers aren’t allowed;

- Limited repayment loan terms.

OVERVIEW

Upstart is a financial platform that enables borrowers with weak credit to get personal loans with flexible payback options. Its key advantage is same-day funding, and there is simply a light credit check conducted throughout the application procedure.

WHO IT’S FOR

Poor credit borrowers who can’t qualify for traditional personal loans.

WHY WE LIKE IT

Upstart does not do credit checks on its customers. Instead, it examines applicants’ whole financial condition. In addition, customers can apply in the morning and receive their personal loan before the end of the day.

LENDER PERKS

- Quick funding (same-day deposit available)

- No origination fees

- Soft credit checks performed

FEES

- Origination fees up to 10%;

- $15 late fee

- $15 NSF fee

REQUIREMENTS

- Be at least 18 years old;

- Prove your US citizenship or permanent residence;

- Provide your bank account information

- Show your monthly income (at least $2,000 monthly income) by providing pay stubs, tax forms, or bank statements;

- Have fair credit (at least 300);

- Provide an active email address and phone number.

TIME OF RECIEVE FUNDS

One business day (same-day funding available)

Editor’s Thoughts: Upstart considers factors beyond your credit score, like education and job history. This option is good for borrowers with limited credit but good earning potential. Loan amounts range from $1,000 to $50,000. APRs range from 6.40% to 35.99%.

★★★★☆

Est.APR

18% – 35.99%

Loan amount

$1,500 – $20,000

Min Score

None

More About

PROS

- Joint and secured loans are available;

- Wide range of loan options for low credit;

- Pre-qualifying doesn’t affect your credit score;

- Convenient options for debt consolidation.

CONS

- Relatively high interest rates;

- Charges origination fees;

- APRs are not disclosed when pre-qualify.

OVERVIEW

OneMain Financial is a reliable financial service that offers personal loans between $1,500 and $20,000 without minimum credit score requirements. With its joint applications, flexible repayment terms, and soft credit checks for pre-qualifying, it can suit borrowers with bad credit. Interest rates are usually high, though.

WHOM IT SUITS

Borrowers with credit issues who want to avoid predatory lenders.

WHY WE CHOOSE IT

The company offers a wide range of secured, unsecured, and joint loan options with flexible repayment terms. Its personal loans are available to underbanked borrowers.

PERKS OFFERED

- Direct payment to creditors for debt consolidation;

- Loan cancellation within 7 days;

- Fast funding

FEES

- Origination fees: 1% to 10%, or $25 to $500, depending on the state;

- Late payment fees: $5 to $30, or 1.5% to 15% of your loan amount;

- Non-sufficient funds fees: $10 to $50 per payment returned.

ELIGIBILITY REQUIREMENTS

- At least 18 years also;

- Permanent US resident;

- Income confirmation;

- Valid bank account or debit card.

FUNDING TIMES

Within one business day of approval via a direct deposit. Funding within several hours may be offered if you receive the funds on your debit card.

Editor’s Thoughts: OneMain offers secured and unsecured personal loans for people with less-than-perfect credit. Loan amounts range from $1,500 to $20,000. APRs range — 18.00% – 35.99%.

★★★★☆

Est.APR

8.49% – 35.99%

Loan amount

$1,000 – $50,000

Min Score

Doesn’t specified

More About

PROS

- No prepayment penalties;

- Multiple rate discounts;

- Next-day funding;

- The due date may be changed;

- Direct payments for debt consolidation.

CONS

- APRs may be high;

- Origination fees are charged;

- Late fees may be applied.

OVERVIEW

Upgrade is an online financial service that offers up to $50,000 loans to borrowers with good to fair credit. It provides several interest rate reductions and allows you to add a co-applicant or collateral to your application. Choose it if you need money quickly and are not concerned about relatively high interest rates.

WHOM IT SUITS

Fair-credit borrowers who need the money quickly.

WHY WE CHOOSE IT

Upgrade offers convenient maximum and minimum loan amounts along with flexible repayment terms. It also accepts fair credit borrowers and provides several interest rate discounts.

PERKS OFFERED

- Rate discounts for auto pay, direct payment, and reward checking;

- Allows to add a co-applicant;

- Mobile app for managing your loan.

FEES

- Origination fees: 1.85% to 9.99%;

- Late payment fees: $10;

- Non-sufficient funds fees: $10 per payment returned.

ELIGIBILITY REQUIREMENTS

- Be a U.S. citizen, a permanent resident, or living in the U.S. on a valid visa;

- Be at least 18 years old (19 in Alabama and some other states);

- Give a working email address;

- Provide valid bank account details;

- Confirm a sufficient monthly income to cover your loan payments.

FUNDING TIMES

As soon as one business day after clearing verification.

Editor’s Thoughts: Upgrade provides personal loans with competitive rates and flexible repayment options. Loan amounts range from $1,000 to $50,000. APRs range from 8.49% to 35.99%. You can check potential rates without affecting your credit score.

★★★★★

Est.APR

58.90% – 299.00%

Loan amount

$300 – $5,000

Min Score

None

More About

PROS

- Quick access to loan funds;

- No prepayment penalties;

- Flexible monthly payments;

- Beyond credit verification (soft credit check).

CONS

- High-interest rates;

- Small loans amounts;

- Not available in all states.

OVERVIEW

Rise is a financial platform that helps borrowers with bad credit get personal loans with flexible repayment terms. Its main advantage is the lack of additional fees, and a minor credit check is performed throughout the application process.

WHO IT’S FOR

Poor credit borrowers who can’t qualify for traditional personal loans.

WHY WE LIKE IT

Rise does not conduct traditional credit checks on its clients. Instead, it looks at applicants’ overall financial situation. Customers can also apply in the morning and obtain their personal loan before the end of the day.

PERKS OFFERED

- Quick funding;

- No origination fees;

- Soft credit checks performed.

FEES

- No fees for late payments or prepayment.

REQUIREMENTS

- Be at least 18 years old;

- Prove your US citizenship or permanent residence;

- Provide your bank account information

- Show your monthly income (at least $2,000 monthly income) by providing pay stubs, tax forms, or bank statements;

- Have fair credit (at least 300);

- Provide an active email address and phone number.

TIME OF RECEIVING FUNDS

One business day (same-day funding not available).

Editor’s Thoughts: RISE offers quick access to cash, even for those with bad credit. APRs are extremely high — ranging from 58.90% to 299%. Loan amounts vary by state, but the maximum is $5,000. Consider RISE only as a last resort.

★★★★☆

Est.APR

8.99-25.81%

Loan amount

$5,000-100,000

Min Score

None

More About

PROS

- Low interest rates

- Co-borrowers are allowed

- No prepayment penalties

- Flexible loan amounts

- Wide repayment terms

- No origination fee

CONS

- Good credit is required

- Late fees might apply

- No co-signer option available

- No physical branches

OVERVIEW

SoFi is a financial website that provides unsecured personal loans with a credit score minimum of 680. Personal loans from SoFi are also accessible with a co-borrower with good to outstanding credit. Personal loan candidates must, however, have an adequate income and a modest debt-to-income ratio.

WHO IT’S FOR

Applicants with good to excellent credit scores who want to consolidate debt, make major purchases, and cover significant medical bills.

WHY WE LIKE IT

SoFi does not do credit checks on its customers. Instead, it examines applicants’ whole financial condition. If you take out a credit builder loan, this service reports your on-time payments to the major credit reporting bureaus.

LENDER PERKS

- No prepayment penalties

- No origination fees

- Low interest rates

- Co-borrower option available

FEES

- Optional fees (up to 6%)

REQUIREMENTS

- Be at least 18 years old

- Prove your US citizenship or permanent residence

- Provide your bank account information and social security number

- Show your monthly income by providing pay stubs, tax forms, or bank statements

- Provide an active email address and phone number

TIME OF RECIEVING FUNDS

One business day

Editor’s Thoughts: SoFi provides personal loans with competitive rates and member benefits — unemployment protection and career coaching. You typically need good or excellent credit to qualify. Loan amounts range from $5,000 to $100,000. APRs are affordable — from 8.99% to 25.81%.

★★★★☆

Est.APR

5.99% – 35.99%

Loan amount

$1,000 – $50,000

Min Score

300

More About

PROS

- Prequalification for multiple personal loans on single platforms

- Low minimum interest rates

- No prepayment penalties

- Fast funding (same-day direct deposit may be available)

CONS

- High maximum interest rates

- Many additional fees (potential origination fee)

- No co-borrower permitted

OVERVIEW

LendingTree serves as a handy platform for seeking personal loans, allowing borrowers to explore a variety of loan offers simultaneously. Many lenders associated with LendingTree can provide loans swiftly. However, the most suitable personal loan depends on your credit score. This score establishes eligibility and influences your interest rate.

WHO IT’S FOR

Borrowers with bad credit scores who want to consolidate debt of up to $50,000 or cover other significant expenses.

WHY WE LIKE IT

LendingTree has accreditation from the Better Business Bureau, a non-profit group dedicated to customer safety and trust. The BBB rates LendingTree as A+, a symbol of excellence. The BBB’s decisions are based on how a company reacts to customer gripes, truth in marketing, and openness about company procedures.

COMPANY PERKS

- No prepayment penalties

- Loan funds in one business day

FEES

- Origination fees, prepayment penalties, or other fees may be applicable

REQUIREMENTS

- Be at least 18 years old

- Prove your US citizenship or permanent residence

- Provide your bank account information

- Show your monthly income (at least $25,000 annually income) by providing pay stubs, tax forms, or bank statements

- Have fair credit (at least 300)

- Provide an active email address and phone number

TIME OF RECIEVING FUNDS

One business day (same-day funding available)

Editor’s Thoughts: LendingTree is a loan marketplace that allows you to compare offers from multiple lenders. It helps you find competitive rates and carefully review each offer’s terms and conditions. Loan amounts and APRs vary depending on the lender and your creditworthiness.

★★★★☆

Est.APR

34.00 – 99.99%

Loan amount

$1,000 – $10,000

Min Score

Not specified

More About

PROS

- Next-day funding

- No application fees or prepayment penalties

- Bad credit is accepted

- Flexible repayment terms

- Convenient minimum loan amounts

CONS

- Very high APRs

- Low loan maximums

- Origination and late payments fees may be charged

- Not available in all states

OVERVIEW

NetCredit is an online lending company that specializes in small personal loans and credit lines for bad credit borrowers. The service offers flexible loan amounts and repayment terms and may work for emergencies due to its fast disbursement times. However, interest rates and fees are higher compared to most competitors.

WHOM IT SUITS

Borrowers with bad credit in need of fast cash.

WHY WE CHOOSE IT

NetCredit offers cheaper alternatives to regular personal loans and provides bad credit individuals with more flexibility. Additionally, it has fast funding times and allows borrowers to improve their credit.

PERKS OFFERED

- The ability to change the due date

- Refinancing with the same lender in some states

- Credit-building opportunities

FEES

- Origination fees: 1% to 5%, depending on your state

- Cash advance fees: 10%

- Late payment fees: vary by state

- Non-sufficient funds fees: None

ELIGIBILITY REQUIREMENTS

- Be a U.S. permanent resident

- Live in a qualifying area

- Be at least 18 years old

- Have a valid email address

- Have a valid personal checking account

- Provide income confirmation

FUNDING TIMES

As soon as the next business day of approval.

Editor’s Thoughts: NetCredit offers quick loan approvals even with bad credit. APRs are very high, ranging from 34.00% to 99.99%. Loan amounts vary by state, with a maximum of $10,000. Look for other options before considering NetCredit.

Tips to Compare Bad Credit Loans for a 500 Credit Score

BadCredify selected the best loans for a 500 credit score, but choosing the lender is up to you. We suggest you pay attention to the following details when you compare bad credit loans:

- Lender’s Trustworthiness. Examine customer testimonials before you deal with a potential loan provider. Choose a reliable website to read the reviews, like TrustPilot or Yelp.

- Eligibility Criteria. Check all the required conditions for you to be eligible before you choose a lender. Qualification criteria may vary depending on the lender and your state laws.

- APRs. You should look for the lowest possible APR and fees available for the loan option you want to apply for.

- Repayment Terms. Check the available repayment schedule — the due dates vary from one loan option to another.

- Customer Support. Make sure the loan provider has operable online support. You never know what difficulties you might encounter, and it’s crucial to get a timely answer in such cases.

Is 500 a Good Credit Score?

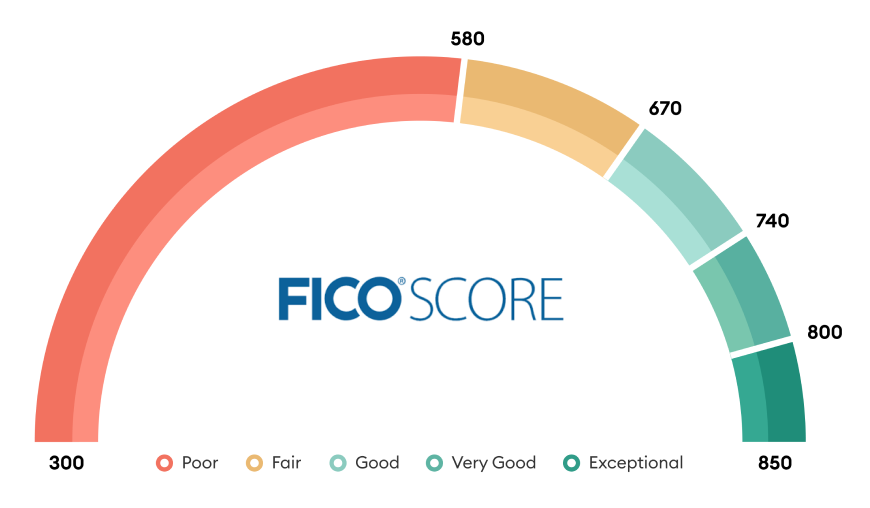

A 500 credit score belongs to the poor credit category. It is also called a “bad credit score”. Poor credit scores range between 300 and 579 on the FICO Credit Score scale. Here’s how credit ratings generally span:

Low credit scores indicate potential problems with repayment that most traditional lenders want to avoid. On the contrary, good credit shows that a borrower is reliable and makes their loan and bill payments on schedule.

A low credit score may also result in higher interest rates and unfavorable loan terms. You may be asked to provide collateral or receive a shorter repayment period.

What Loans Can I Get with a 500 Credit Score?

Getting a loan is harder when you have a poor credit score, but it’s still possible. Here are some options for a 500 credit score.

Secured Personal Loans

Secured personal loans require you to provide something valuable as a means of security — collateral. Secured loans are significantly easier to get for bad credit borrowers as lenders don’t risk too much. In case of default, they have a right to repossess and sell your property.

Credit-Builder Loans

A credit-builder loan gives you an opportunity to establish or enhance your credit history. The main difference here is the monthly payments that must be made upfront rather than receiving and repaying the loan. All these payments are deposited into a savings account, and you will receive the money after the repayment period ends. Each monthly payment you make is reported to major credit bureaus, improving your credit score.

Installment Loans

An installment loan is a subtype of a traditional personal loan with some differences. It has a lower loan amount and is available to individuals with bad credit scores. The repayment period is also shorter — installment loans usually must be repaid for up to 2 years. It is a good option that allows you to manage your debt in equal monthly payments, even though the interest rate will be higher compared to standard personal loans.

Payday Loans

Payday loans are given until your next paycheck. They are short-term and feature extremely high-interest rates. They must be repaid in one lump sum within 31 days maximum. Most payday lenders don’t conduct hard credit report checks — those won’t be sent to credit bureaus. They are quick and easy to get, but we strongly recommend you to use them as a last resort option. The APRs for payday loans may exceed 420%.

Credit Cards

There are credit cards available to borrowers with a 500 credit score, but your options will be limited. Some bad credit cards may also require a security deposit. They also have credit limits, which may be pretty low for borrowers with bad credit. Some credit card issuers provide grace periods — a certain time frame with 0% APRs. You can use the money for free if you can return it before the grace period expires. If you overdue your payment even for a minute, you will get quite costly interest fees on your outstanding balance.

Auto Loans

Individuals with a 500 credit score may opt for auto loans if they can handle an initial payment of at least 20% of the car’s price. Auto loans are secured ones — that means that a loan lender will use a car you buy as collateral. Should you default your loan — a lender will repossess your car and your down payment won’t be refunded.

Credit Union Loans

Credit unions are non-profit organizations that help the local communities to resolve their financial troubles. Credit union loans feature lower-than-usual interest rates and more lenient eligibility criteria. CUs tend to provide personal loans for bad credit borrowers as well. However, you must have a membership in order to get one. We advise you to do some research and find a union in your hood to get more details.

Mortgages

Traditional mortgages require a good or a very good credit score to be eligible. You may search for government-supported programs which include USDA loans, FHA loans and VA loans. On certain conditions, they may provide preferential interest rates and more relaxed terms for vulnerable groups of citizens.

Online Loans

There are a lot of online lenders who provide alternative loans for individuals with a bad credit score. They are easy to get, they feature fast funding, but they are usually expensive. Most online loans are unsecured, which forces lenders to mitigate their risks by increasing the price.

Get a Personal Loan with a 500 Credit Score

- Does not affect your FICO credit score

- Competitive interest rates and terms

- Receive cash within one business day

Loans for a Credit Score of 500 — Rates and Terms

Many different factors could affect the terms of this type of loan: your income, debt-to-income ratio, the state in which you reside, and overall financial behavior. Each lender sets its own terms and rates, so loans for a credit score of 500 are not created equally. Some common details may include:

- ARPs: up to 35.99% for regular loans. Some options can have an annual percentage rate of over 420%;

- Repayment periods: from several weeks to 60 months;

- Loan amounts: from $100 to $50,000 (maybe even higher for mortgages);

- Fees: origination fees typically range from 1% to 10%. Late fees and prepayment penalties may apply.

Tips to Get a Personal Loan with a 500 Credit Score

Each lender requires you to follow their own unique algorithm for obtaining a personal loan. With a credit score of 500, the most common path includes the following steps:

- Shop Around — Compare Loan Lenders. Look at several different options and choose loan providers with suitable eligibility requirements and loan terms.

- Complete Pre-qualification. This process usually occurs online and doesn’t affect your credit score. You will be asked to provide some basic personal and financial information.

- Examine Potential Loan Terms. Pay particular attention to APRs, repayment terms, and overall trustworthiness to choose the best offer.

- Complete The Loan Application. This usually involves providing supporting documents. Some lenders may allow an online process, while others will ask you to visit a store. At this step, a lender may conduct a hard credit check.

- Accept The Loan Offer. If approved, you need to sign a loan agreement to receive the funds.

- Get Your Money. Lenders typically transfer funds via direct deposit into your active checking account. The process can take from one business day to several weeks.

Expert Tip: Consider a co-signer with good credit to improve your approval odds and potentially secure a lower interest rate.

Eligibility Requirements for a 500 Credit Score Loan

Most online lenders from our top work with bad credit borrowers and set lenient requirements for getting 500 credit score loans. These are the most common ones:

- Have a legal US citizenship or be a permanent US resident;

- Be at least 18 or older;

- Have a State ID or driver’s license;

- Have a steady source of income ($1,000/month or more);

- Provide basic contact details such as email and phone number;

- Have a valid, active checking account.

While the things mentioned above are usually enough, some loan lenders may also look at your debt-to-income ratio and have various credit score requirements depending on the loan product you wish to qualify for.

Ways to Improve Your Credit Score

Your credit score matters not only for lenders but for you as well. A higher credit score allows you to get more loan offers from different lenders with drastically better rates and terms. We advise you to improve your credit score before applying — you’ll potentially save a good amount of money. Here’s what you can do:

- Maintain a Healthy Debt-to-Income Ratio. Don’t rely on loans too much — your debts directly affect your credit score. Lenders like to see your debt payments below 43% of your income. Ideally, aim for 36% or less. This shows them you can handle your current debts and afford a new loan.

- Lower Your Credit Utilization Rate. Paying off high-cost credit card balances may significantly decrease your credit utilization rate.

- Start Building Your Credit History. There are special types of loans that are designed mainly for individuals with no credit history — credit-builder loans. Alternatively, you may issue a secured credit card. Its responsible usage will help you create your first records in credit reports.

- Don’t Miss Your Loan Due Dates. Paying your debts on time is the most reliable way to increase your credit score.

- Avoid Closing CC Accounts. Terminating your credit card account may affect your credit mix and length of credit.

Expert Tip: Another way to reduce your credit utilization rate is to request a higher credit limit from your credit card issuer.

Alternatives to 500 Credit Score Loans

Haven’t found what you’re looking for among the options provided? You can try to get cash in other ways:

- Borrow money from friends and family. It’s the most available option for those who get rejected by loan lenders, but we advise you not to abuse the trust of your loved ones. Pay back what you borrowed from them on time.

- Cash Advance Mobile Applications. You can easily get a small amount from these apps, but they may have very high fees and APR. Also, there are a lot of scam apps, so you should always check the legitimacy of those twice.

- Pawn Shop Loans. Pawn brokers require something valuable from you to provide you with cash, and you always get only a small fraction of the value of the pledged item. Should you fail to repay, the pawn shop lender may legally repossess your item.

- P2P Lending Services. Peer-to-peer lending platforms provide a space for borrowers to connect directly with individual investors, bypassing traditional financial institutions. This alternative lending method often yields lower interest rates and greater flexibility in loan terms compared to other options available for individuals with lower credit scores.

Methodology

BadCredify’s evaluation process begins with an extensive review of personal loan options offered by more than 40 lenders and financial institutions. We gather detailed information from each lender and verify it through their websites and customer feedback.

Our experts test the pre-qualification procedure, thoroughly reviewing the terms offered. We meticulously consider various factors, including interest rates, fees, repayment terms, safety, convenience, funding times, and eligibility criteria. Subsequently, we select the lender that offers the most favorable terms.

FAQ

A 500 credit score is considered a bad credit score — it shows that you’ve made some financial mistakes in the past or you have a lack of credit history.

Lenders evaluate your financial responsibility using your FICO Credit Score — it acts like a security measure for them. People with extremely low credit scores tend to default on their debts, that’s why it’s harder for them to get loan approval.

Borrowers with a 500 credit score may get credit union loans, secured personal loans, or auto loans, use a credit card, or turn to alternative loan lenders. They provide online loans for bad credit, like payday loans and installment loans.

It depends on your income, state, the lender, and the type of loan you qualify for. Borrowers with a 500 credit score may usually get from $100 to $5,000 with unsecured loans. Secured loans may allow you to get up to $100,000 or even more, provided that your income is high enough.

Many traditional loan lenders allow you to get cash online only if you have a good credit score. Alternative lenders from our top allow you to submit your loan application online with bad credit.