On This Page:

What Is an Annual Percentage Rate (APR)?

Factors That Affect My Loan APR

Interest Rate vs. APR: What’s The Difference?

Discover Your Personalized APR Options

- Check personalized rates from multiple lenders in just 2 minutes

- Explore loans ranging from $500 to $100,000

- This will NOT impact your credit score

Borrowing money typically comes with additional costs. Whatever type of credit you secure, an annual percentage rate is common for all of them. In a nutshell, APRs mean the annual costs of loans. They consist of both an interest rate and fees on the amount you borrow. However, an APR comes with several subtleties and features that are crucial to understand before going into debt. Let’s delve deeper and find out what an APR is and how it works.

Highlights:

- An annual percentage rate meaning is a yearly loan price. It includes both interest rates and fees;

- In some cases, an APR can be the same as an interest rate;

- APRs can be fixed or variable. While fixed rates provide more stability, variable ones are initially lower;

- The APR is used to compare various loan options in terms of their costs as it fairly represents a yearly loan price. This helps borrowers avoid misleading advertisements.

What Is an Annual Percentage Rate (APR)?

An annual percentage rate (APR) is a charge that represents how much money you will pay for using your loan over one year. An APR is expressed in a certain percentage of your initial loan amount. It consists of the actual rate charged for borrowing money (interest rate) and any associated fees, such as an application fee or annual card fee.

A lower APR is always a better deal for borrowers. Therefore, it’s one of the key factors people pay attention to when seeking financial assistance. Just keep in mind that lenders usually specify representative APRs on their websites, which may differ from the real ones you will get.

Representative APR Definition

A representative APR is an annual percentage used by lenders to advertise their products. It’s calculated based on the rates offered to at least 51% of applicants. Simply put, it shows what loan price is most likely to be offered to the majority. However, there are still up to 49% of applicants who can get higher APRs. Thus, it’s quite common for borrowers to receive less favorable offers after they have submitted their final applications.

How Does APR Work?

An APR helps customers understand the real loan cost and compare loan options more easily. While two loans may have the same interest rate, their APRs can differ significantly. An APR provides a fair picture of the yearly loan price as it includes all the extra fees associated with your borrowing. Lenders are obliged to disclose their APRs in the loan agreement to give customers a better understanding of what they are going into.

When it comes to credit cards and other revolving lines of credit, an APR usually equals an interest rate. This means you will pay interest on an unpaid amount each time you carry your balance over to the next cycle. These interest charges will be the same as your APR. If you pay off your balance in full each month, no interest will accrue.

How to Calculate an APR?

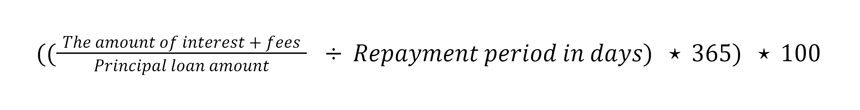

The first step you need to take to calculate an APR is to divide the amount of interest and fees by the principal loan amount. Then, you divide the result by the number of days of your repayment period. This will help you determine your daily interest. The next step is to multiply the result by 365, which refers to the number of days in a year. Finally, you need to multiply the number you get by 100.

Summing up, an APR formula is as follows:

Different Types of APRs

APRs vary based on the form of consumer credit you use. As loans and credit cards work differently, they also have their unique APR types. Here’s a close look at the options.

What Is an APR on a Loan?

It’s generally accepted that there are two types of APR on a loan:

- Fixed APR. A fixed APR means that it’s stable and doesn’t change over the entire loan life. Most borrowers prefer fixed rates as they provide a sense of stability and predictability. A fixed rate is usually applied to traditional personal loan, auto loan, and short-term loan options;

- Variable APR. A variable APR is one that can change at any moment under certain economic or lending market conditions. Although it comes with the risk of rising and increasing your loan cost, it’s also initially lower. Some personal loans, student loans, and adjustable-rate mortgages come with variable interest rates.

What Is an APR on a Credit Card?

A credit card APR depends on the type of transaction you make and sometimes on the time you pay. Here are several types:

- Purchase APR. This APR is simply a credit card interest charged each time you make a new purchase. It’s usually the one that is outlined first in your credit card agreement;

- Cash advance APR. Most credit card issuers provide the ability to get credit card cash advances. They come in the form of cash amounts you can withdraw from your available credit card balances within a certain limit. A cash advance APR is typically higher than a purchase APR. Another difference is that it accrues immediately, while a purchase APR may apply only after an interest-free grace period;

- Balance transfer APR. A balance transfer APR accrues each time you make balance transfers. It’s typically greater than a purchase APR;

- Introductory APR. An introductory APR is usually applied to your purchases during the promotional (introductory) period. In most cases, it equals 0%. This means that if you pay off your credit card balance before the introductory period ends, there will be no interest to pay;

- Penalty APR. This APR arises when you’re late on your credit card payments. A penalty APR is typically higher than the regular one.

Factors That Affect My Loan APR

Your loan type is not the only factor that affects your APR. Here are a few more parameters lenders look at:

- Prime rate. The prime rate is set by the Federal Reserve and serves as a benchmark that lenders use to determine their interest rates. If it increases, lenders will raise their APRs, too. This parameter can affect an annual rate for new or variable-rate loans;

- Credit history. Each time you borrow money, a lender assesses your credit score and history to evaluate your financial situation and the likelihood of getting its money back. Having a good credit score typically results in a lower rate, while bad credit comes with a higher loan cost;

- Debt-to-income ratio. The ratio shows how much debt you owe compared to the amount you earn on a monthly basis. It’s recommended to maintain your DTI within 30% to 43% to secure better loan terms and lower APRs;

- Annual income. Besides looking at your credit score, loan providers also want to be certain of your ability to repay the funds. Therefore, solvent borrowers typically get more reasonable APRs;

- Loan amount. A lower requested amount can save you money, as it typically offers a lower interest rate. Additionally, it comes with less strict income requirements and makes you look more solvent;

- The repayment terms. Loans with shorter repayment periods are usually considered less risky, so they often come with lower APRs. It also has a positive effect on the total amount of interest you pay. However, short-term loans come with higher monthly payments;

- Down payment. If your loan involves a down payment, its amount also plays a role. By making a higher down payment, you can get a lower annual rate;

- Location. Each state may have its own rules and regulations regarding loans, including the APR maximums. Thus, your state of residence can also affect your loan cost.

What Is a Good APR?

The answer depends on the type of loan you’re considering, as well as your credit history. Each loan option has its own averages and what is considered good ranges. Additionally, borrowers with bad credit may consider those rates that seem very high to people with good ratings very decent. Here are a few examples:

Personal loan APRs: An average personal loan APR can be anywhere from 5.99% to 35.99%. Good credit borrowers can consider an APR of 13.5% to 15.9% good, while people with low scores will find an APR of 19% to 21% quite reasonable.

Credit card APRs: A good APR for a credit card is about 14%. However, borrowers with bad credit are most likely to get a rate of about 24% and consider it fair.

Auto loan APRs: Auto loan APRs of 5.6% to 7.5% are considered good for strong credit. An APR of 14% to 17% is the average rate offered to people with credit issues.

Private student loan APRs: A fixed APR of 5% or lower is great for undergraduate students. If you get a student loan at a variable rate, a good APR is about 4.11%. However, bad credit can lower your expectations and increase your rate to about 10%.

Mortgage APRs: Mortgages for home buyers with strong credit can be considered good if an APR is in the mid-6 range. However, it also depends on the down payment you make and the repayment period you choose.

How Can I Get a Lower APR?

Here is a list of specific actions and steps that will help you get a lower APR:

- Maintain good credit. This is quite simple: a low credit score always results in a higher APR. By boosting your credit, you can potentially decrease your future loan costs. If your credit score is bad, consider taking out a credit-builder loan or a secured credit card. Also, keep track of your loan and bill due dates and make on-time payments;

- Lower your DTI. Pay off some high-interest debts and keep the accounts open. This will help you lower your debt-to-income ratio;

- Request a lower loan amount for a shorter term. As these two factors make your loan less risky for a borrower, they may offer you a better APR;

- Make a higher down payment. If you’re seeking a mortgage or an auto loan, consider increasing the amount you pay to a lender upfront. This will positively affect your annual rate;

- Demonstrate a strong payment history. Paying your bills and loans on schedule indicates responsible financial behavior, improving your chances of getting a lower rate;

- Get a secured loan. Consider providing a pledged asset that will serve as an extra repayment guarantee. You can use your house, car, or savings account balance as collateral. Just note that a lender can seize it if you default;

- Bring a co-signer. Adding a co-signer with good credit and strong income will help you get better loan terms;

- Specify all the income sources. If you have extra income you can verify, such as income from self-employment, add it to your application.

Interest Rate vs. APR: What’s The Difference?

Both an APR and interest rate represent the loan cost. However, a loan’s interest rate is a part of an annual percentage rate. In some cases, an APR can be the same as an interest rate, but this can be true only for revolving lines of credit. In most cases, an interest rate is lower than an APR as it doesn’t include any other fees and costs that may arise.

For example, a mortgage interest rate doesn’t take into account closing costs, which can highly affect the total loan price. Interest rates also don’t account for origination fees, insurance, broker fees, and other potential charges.

Difference Between APR vs. APY

While an APR determines the total cost of your borrowing per year, an annual percentage yield (APY) is about the amount you earn per year from a deposit account. Simply put, an APY is a rate of return on an investment.

Final Thoughts

Understanding an APR will help you compare loans more effectively and choose the option at a lower cost. An annual rate can vary widely depending on the loan type, your credit score, location, loan amount, repayment terms, and other factors. Therefore, you need to take all the variables into account when comparing loan options based on their APRs.